Fund Accounting

The activities of the County are organized into separate funds that are designated for a specific purpose or set of purposes. Each fund is considered a separate accounting entity, so the operations of each fund are accounted for with a set of self-balancing accounts that comprise its revenues, expenses, assets, liabilities, and fund equity as appropriate.

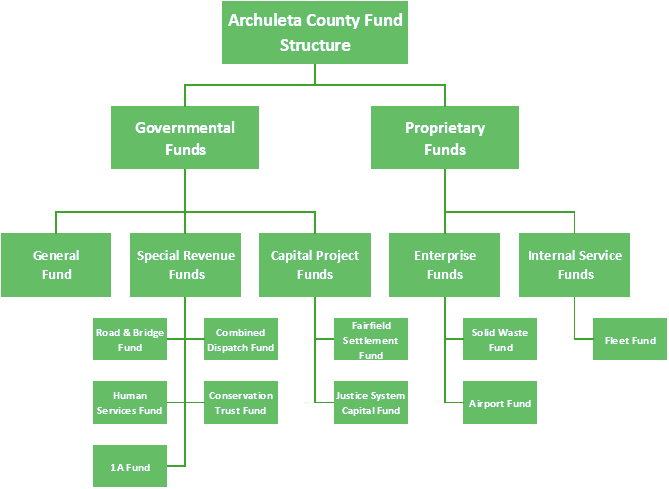

The number and variety of funds used by the County promotes accountability but can also make budgeting and finance complex. Therefore, understanding the fund structure is an important part of understanding the County’s finances. The three basic fund categories are Governmental Funds, Proprietary Funds and Fiduciary Funds; within each fund category there are various fund types. Following is a description of the six fund types that contain the County’s various funds.

Governmental Funds

General Fund

The General Fund is the County’s primary operating fund and is used to track the revenues and expenditures associated with the basic County services that are not required to be accounted for in other funds. This includes services such as Sheriff, Assessor, Clerk, Treasurer, Administration, and other support services such as Finance and Human Resources. These services are funded by general purpose tax revenues and other revenues that are unrestricted. This means that the County Commissioners, with input from the public, has the ability to distribute the funds in a way that best meets the needs of the community as opposed to other funds that are restricted to predefined uses.

Special Revenue Funds

Special Revenue Funds account for activities supported by revenues that are received or set aside for a specific purpose that are legally restricted. The Government Accounting Standards Board or GASB has issued statement 54 which requires the elimination of Special Revenue Funds without a specific revenue source that is restricted or committed and is a substantial portion of the Fund’s revenues. Due to this standard the County has eliminated several Funds that did not comply with this statement. The County now has five Special Revenue Funds; Road & Bridge Fund, Department of Human Service Fund, Conservation Trust Fund, Combined Dispatch Fund, and the 1A Fund.

Capital Projects Funds

Capital Projects Funds account for and report financial resources that are restricted, committed, or assigned to expenditure for capital outlays including the acquisition or construction of capital facilities and other capital assets, and are frequently required by debt covenants, grant contracts, law, or regulation. Capital Projects Funds can be a valuable management tool for multi-year projects. The County has two Capital Projects Funds; the Justice System Capital Fund and the Fairfield Settlement Fund.

Proprietary Funds

Enterprise Funds

Enterprise Funds account for operations that are financed and operated in a manner similar to private business, where the intent of the County is that the fund will be self-supporting. This requires that the expense of providing goods and services to the general public on a continuing basis be financed or recovered primarily through user charges. In the event that these user charges are insufficient to cover the operations of the Enterprise fund, transfers can be made from other fund types to provide additional support. The County’s Enterprise Funds consist of the Solid Waste Fund and the Airport Fund.

Internal Service Funds

Internal Service Funds account for the financing of goods and services provided primarily by one County department to other County departments or spending agencies, on a cost reimbursement basis. Currently, the only Internal Service Fund is the Fleet Service Fund.

Fiduciary Funds (Trust and Agency Funds)

Fiduciary Funds

Fiduciary Fund financial statements consist of Trust Funds and Agency Funds established to record transactions relating to assets held by the County in a trustee capacity or as an agent for individuals, governmental entities, and non-public organizations. Agency Funds are custodial in nature (assets equal liabilities) and do not involve measurement of results of operations.